Regions Online Banking Access, Features, Security, and Support

In today’s digital age, online banking has become an essential part of managing our finances efficiently. Regions Bank offers its customers the convenience and flexibility of accessing their accounts through Regions Online Banking. This article will provide you with in-depth information about Regions Online Banking, including how to access it, its features and benefits, security measures, account management options, mobile banking capabilities, fund transfers, bill payments, troubleshooting tips, and customer support. Let’s dive into the world of Regions Online Banking and explore its offerings.

How to Access Regions Online Banking

Accessing Regions Online Banking is a straightforward process that enables you to manage your accounts from the comfort of your home or on the go. To get started, follow these steps:

- Visit the official Regions Bank website at www.regions.com.

- Click on the “Log In” button located at the top-right corner of the homepage.

- Enter your unique User ID and Password in the designated fields.

- Click the “Log In” button to access your Regions Online Banking account.

Features and Benefits of Regions Online Banking

Regions Online Banking provides a wide range of features and benefits to enhance your banking experience. Here are some notable ones:

- Account Overview: Get an overview of all your Regions Bank accounts in one place, including checking, savings, loans, and credit cards.

- Transaction History: View detailed transaction history, allowing you to track your expenses, deposits, and withdrawals easily.

- Bill Pay: Set up and manage bill payments conveniently, eliminating the need for writing checks or visiting physical locations.

- Mobile Deposit: Deposit checks using your smartphone by simply capturing images of the check and submitting them through the Regions Mobile Banking app.

- eStatements: Access and view your bank statements electronically, reducing paper waste and providing a secure way to store financial records.

- Budgeting Tools: Use Regions’ budgeting tools to set financial goals, track spending habits, and create personalized budgets.

- Alerts and Notifications: Receive email or text alerts for various account activities, such as low balances, large withdrawals, or upcoming bill payments.

Step-by-Step Guide for Setting Up Regions Online Banking

Setting up your Regions Online Banking account is quick and easy. Follow these step-by-step instructions:

- Visit the Regions Bank website and click on the “Enroll” button located next to the login area.

- Provide the required personal information, including your Social Security number, date of birth, and account details.

- Create a unique User ID and Password for accessing your online banking account.

- Review and accept the terms and conditions of using Regions Online Banking.

- Set up additional security measures, such as security questions and two-factor authentication, to enhance the safety of your account.

- Verify your information and complete the enrollment process.

Security Measures in Regions Online Banking

Regions Bank prioritizes the security and privacy of its customers’ financial information. Here are some robust security measures implemented in Regions Online Banking:

- Encryption: All data transmitted between your device and Regions Bank’s servers is encrypted using industry-standard SSL/TLS encryption protocols, ensuring secure communication.

- Multi-Factor Authentication: Regions Online Banking uses multi-factor authentication to verify your identity, requiring a combination of credentials such as passwords, security questions, or biometric authentication.

- Automatic Timeouts: To prevent unauthorized access, your online banking session will automatically time out after a period of inactivity.

- Account Alerts: Set up account alerts to receive notifications for any suspicious activity or changes made to your account.

- Privacy Controls: Customize your privacy settings to control the information shared with third-party providers and ensure your data is protected.

Managing Accounts Through Regions Online Banking

Regions Online Banking provides a comprehensive suite of tools for managing your accounts effectively. Here are some key functionalities:

- Balance Inquiries: Check your account balances in real-time to stay on top of your finances.

- Funds Transfers: Transfer funds securely between your Regions Bank accounts or to other external bank accounts.

- Account Statements: Access and download electronic account statements and transaction history for record-keeping purposes.

- Stop Payments: Easily place stop payments on checks to prevent unauthorized transactions.

- Account Customization: Personalize your online banking experience by organizing accounts, setting up favorites, and creating custom categories.

Mobile Banking Options with Regions

Regions Bank understands the importance of mobile banking in today’s fast-paced world. They offer various options for accessing your accounts on the go:

- Mobile App: Download the official Regions Mobile Banking app from your device’s app store. It allows you to perform a wide range of banking activities, including balance inquiries, fund transfers, bill payments, and check deposits.

- Mobile Web: Access Regions Online Banking directly through your mobile device’s web browser. The mobile-optimized website provides a seamless and user-friendly experience.

- Text Banking: Receive account updates, transaction alerts, and even perform basic banking tasks by sending simple text commands to a designated number.

Mobile banking with Regions ensures that you can manage your finances conveniently, no matter where you are.

Transferring Funds using Regions Online Banking

Regions Online Banking offers various options for transferring funds securely and efficiently. Here are the different methods available:

- Internal Transfers: Transfer money between your Regions Bank accounts, such as from your checking account to your savings account, with just a few clicks.

- External Transfers: Set up external transfers to move funds between your Regions accounts and accounts at other financial institutions. You can link external accounts and schedule one-time or recurring transfers.

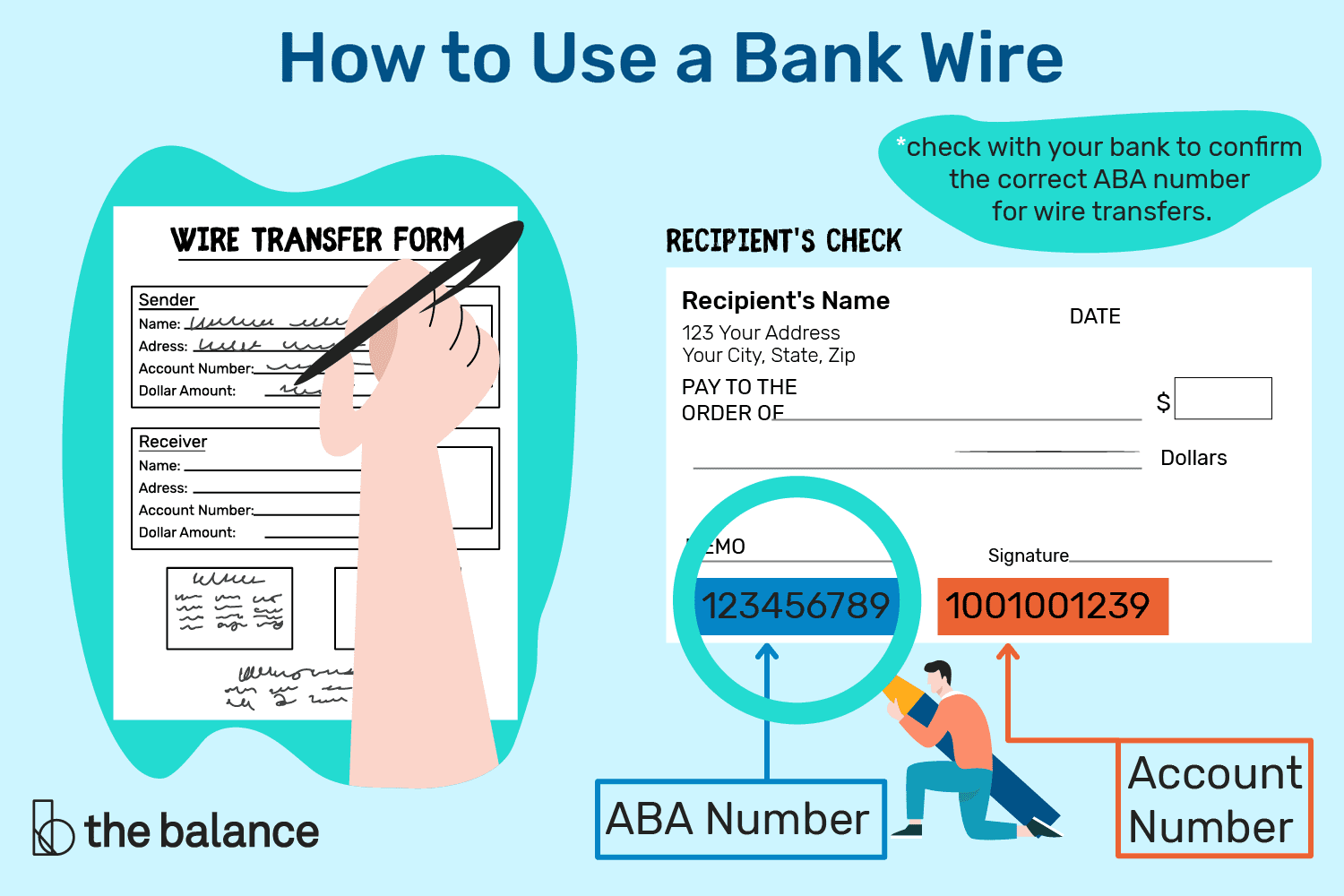

- Wire Transfers: Initiate wire transfers to send money domestically or internationally. This service is particularly useful for large amounts or time-sensitive transactions.

Regions Online Banking ensures that your funds are transferred quickly and reliably, giving you control over your finances.

Paying Bills Online with Regions Bank

Gone are the days of writing checks and mailing them to pay bills. Regions Bank offers a convenient and secure online bill payment service. Here’s how it works:

- Set Up Payees: Add the companies or individuals you need to pay regularly as payees in your Regions Online Banking account. This can include utility providers, credit card companies, or even your landlord.

- Schedule Payments: Choose the payment amount, date, and frequency for each bill. You can set up one-time payments or recurring payments based on your preferences.

- Payment Processing: Regions Bank will process and deliver the payments to your designated payees electronically or by mail, ensuring they receive the funds promptly.

With online bill payment through Regions Bank, you can save time, eliminate the hassle of writing checks, and have better control over your finances.

Troubleshooting Tips for Regions Online Banking

While Regions Online Banking strives to provide a seamless experience, you may encounter occasional issues or have questions. Here are some common troubleshooting tips:

- Clear Browser Cache: Clearing your browser cache can resolve issues related to outdated or conflicting data.

- Disable Browser Extensions: Some browser extensions or add-ons can interfere with online banking functionality. Try disabling them temporarily to see if that resolves the issue.

- Update Browser: Ensure that you’re using the latest version of your web browser, as outdated versions may not be fully compatible with online banking features.

- Contact Customer Support: If you’re unable to resolve the issue on your own, reach out to Regions Bank’s customer support for assistance. They have dedicated teams available to help with technical problems and general inquiries.

By following these troubleshooting tips, you can quickly address any issues and continue enjoying the benefits of Regions Online Banking.

Contacting Regions Customer Support for Online Banking

If you need further assistance with Regions Online Banking, the bank provides several ways to contact their customer support:

- Phone: Call the Regions Customer Service hotline at 1-800-REGIONS (1-800-734-4667) to speak with a representative who can assist you with any online banking inquiries or issues.

- Online Chat: Visit the Regions Bank website and initiate an online chat session with a customer support agent for real-time assistance.

- Branch Visits: If you prefer face-to-face support, you can visit your nearest Regions Bank branch and speak directly with a representative.

Regions Bank is committed to providing excellent customer service and ensuring that your online banking experience is smooth and trouble-free.

Conclusion

Regions Online Banking offers a comprehensive suite of features, robust security measures, and convenient access to your accounts. With this powerful tool, you can manage your finances effectively, transfer funds securely, pay bills conveniently, and enjoy the flexibility of mobile banking options. Should you encounter any issues or have questions, Regions Bank’s customer support is readily available to assist you. Embrace the benefits of online banking with Regions and take control of your financial journey.

In conclusion, Regions Online Banking provides a wide range of features, strong security measures, and convenient account access. This powerful tool allows you to effectively manage your finances, securely transfer funds, conveniently pay bills, and enjoy the flexibility of mobile banking options. If you encounter any issues or have questions, Regions Bank’s customer support is readily available to assist you. Embrace the benefits of online banking with Regions and take control of your financial journey.