The Importance of Financial Reporting and Analysis Example A Comprehensive Guide

As businesses continue to grow and expand, it’s critical to understand the importance of financial reporting and analysis example. Financial reporting and analysis are essential to any organization as they provide insights into a company’s financial performance and help stakeholders make informed decisions. In this article, we will explore the significance of financial reporting and analysis and provide examples, comparisons, and advice to help you better understand its importance.

What is Financial Reporting and Analysis Example?

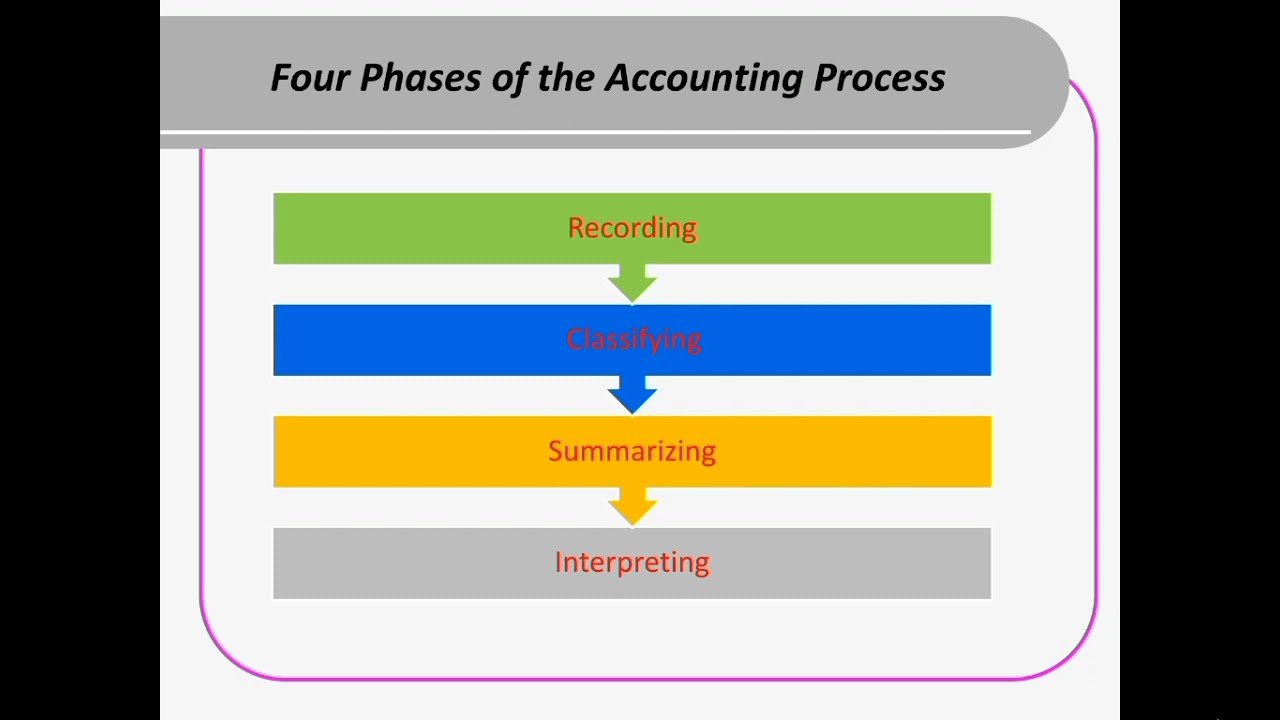

Financial reporting and analysis refer to the process of preparing financial statements, analyzing them, and drawing meaningful conclusions from the financial data. Financial reporting involves creating and sharing various financial reports, such as balance sheets, income statements, cash flow statements, and shareholders’ equity statements.

On the other hand, financial analysis involves reviewing and interpreting financial statements to gain insights into the financial performance of a business. Financial analysts use financial ratios and other analytical tools to analyze financial data and provide recommendations to improve financial performance.

Examples of Financial Reporting and Analysis

One excellent example of financial reporting and analysis is the annual report prepared by public companies for their shareholders and other stakeholders. An annual report provides an overview of a company’s financial performance and highlights key metrics, such as revenue, net income, and earnings per share.

Another example of financial reporting and analysis is a monthly financial statement prepared by small businesses. Monthly financial statements help business owners track their financial performance and identify areas where they need to improve.

Comparisons of Financial Reporting and Analysis

Financial reporting and analysis play a crucial role in decision-making and strategic planning. Without accurate financial reporting and analysis, organizations cannot make informed decisions, and their growth and success are at risk.

Effective financial reporting and analysis can help businesses in several ways, including identifying areas where they need to cut costs, improving cash flow management, measuring financial performance against industry benchmarks, and making data-driven decisions.

In contrast, poor financial reporting and analysis can lead to disastrous consequences. Organizations may not be able to identify their strengths and weaknesses, make wrong investment decisions, and may even face legal or regulatory consequences.

Advice for Financial Reporting and Analysis

To ensure effective financial reporting and analysis, businesses need to follow certain best practices. Here are some tips to help you maintain accurate financial records and analyze them effectively:

- Use accounting software to automate financial reporting tasks and reduce errors.

- Standardize your chart of accounts to ensure consistency and accuracy across financial statements.

- Ensure all transactions are accurately recorded in the books of accounts.

- Use financial ratios and other analytical tools to gain insights into financial performance.

- Regularly review and update your financial policies and procedures to ensure compliance with regulatory requirements.

By following these best practices, businesses can improve their financial reporting and analysis capabilities and make informed decisions that drive growth and success.

FAQs

Q1. Why is financial reporting and analysis important?

A1. Financial reporting and analysis provide insights into a company’s financial performance and help stakeholders make informed decisions. Effective financial reporting and analysis can help businesses identify areas where they need to cut costs, improve cash flow management, measure financial performance against industry benchmarks, and make data-driven decisions.

Q2. What are some common financial reports?

A2. Some common financial reports include balance sheets, income statements, cash flow statements, and shareholders’ equity statements.

Q3. What are financial ratios?

A3. Financial ratios are mathematical calculations used to evaluate a company’s financial performance. They provide insights into a company’s liquidity, profitability, and debt management.

Q4. Can financial reporting and analysis help small businesses?

A4. Yes, financial reporting and analysis are essential for small businesses to track their financial performance and identify areas where they can improve.

Q5. What are some best practices for financial reporting and analysis?

A5. Some best practices for financial reporting and analysis include using accounting software to automate financial reporting tasks, standardizing the chart of accounts, accurately recording all transactions, using financial ratios and analytical tools to gain insights into financial performance, and regularly reviewing and updating financial policies and procedures.

Conclusion

Financial reporting and analysis example play a vital role in any organization’s growth and success. By maintaining accurate financial records and analyzing them effectively, businesses can make informed decisions that drive growth and profitability. However, without proper financial reporting and analysis, organizations can face disastrous consequences. Therefore, it’s essential to follow best practices and use analytical tools to gain insights into financial performance .