Swift Financial A Guide to Fast and Secure Transactions

Are you tired of waiting for days or even weeks for your financial transactions to go through? Do you want a fast and secure way of making payments and receiving funds? Look no further than Swift Financial.

Swift Financial is a global network that provides a secure and efficient system for sending and receiving money. In this article, we will explore what Swift Financial is, its benefits, and how it compares to other financial systems. We’ll also provide some advice on how to make the most out of Swift Financial.

What is Swift Financial?

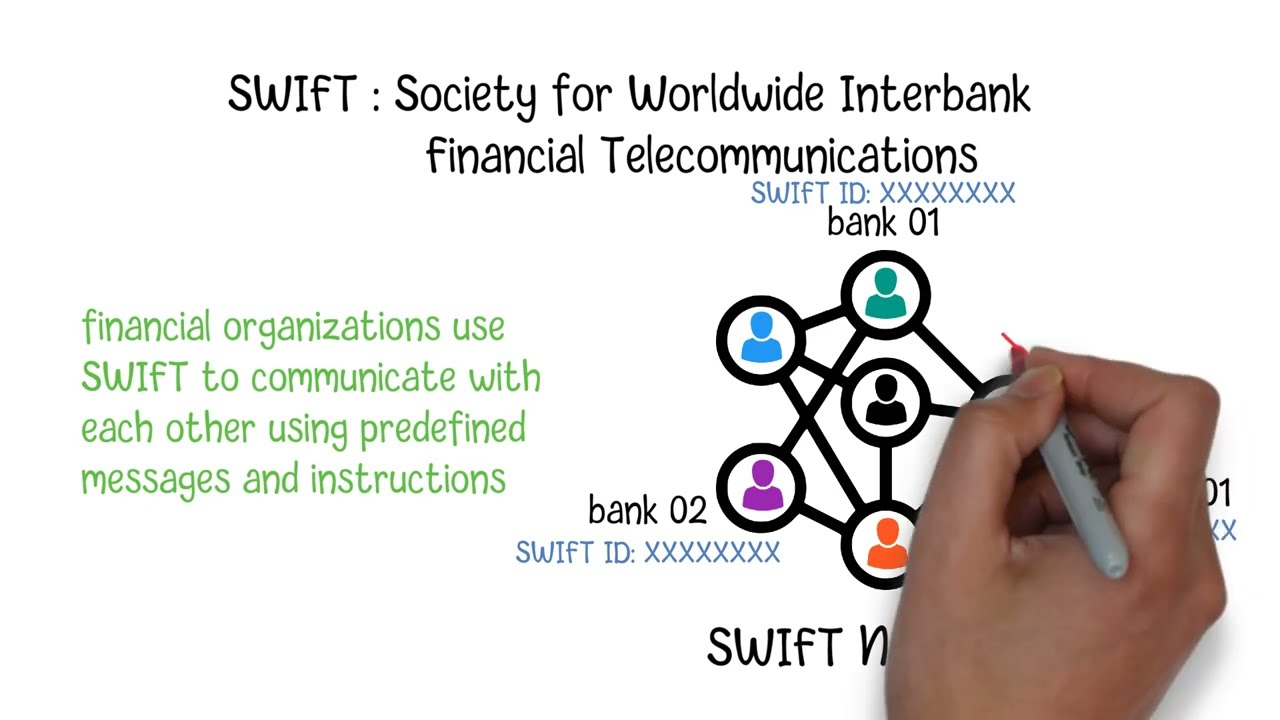

Swift Financial, also known as the Society for Worldwide Interbank Financial Telecommunication, is a global network that connects more than 11,000 financial institutions worldwide. Established in 1973, the system enables its members to securely transfer money between them.

Swift Financial messages are standardized, which ensures that transactions are consistent across borders. The system processes an average of 35 million messages per day, with a total value of $5 trillion.

Examples of Swift Financial in Action

Swift Financial is used by many businesses and individuals worldwide. Here are some examples of how it’s used:

- Businesses use Swift Financial to pay suppliers and receive payments from customers.

- Banks use Swift Financial to settle international transactions.

- Individuals use Swift Financial to send money to family and friends abroad.

How Swift Financial Compares to Other Financial Systems

When it comes to sending and receiving money, there are several options available. Here’s how Swift Financial compares to other financial systems:

Swift Financial vs. PayPal

PayPal is a popular payment system that allows users to send and receive money online. While PayPal is convenient, it can take up to three days for funds to clear. This delay can be frustrating for people who need to access their funds quickly.

Swift Financial, on the other hand, can process transactions within minutes, making it ideal for urgent payments.

Swift Financial vs. Western Union

Western Union is a money transfer service that allows users to send and receive money worldwide. Like PayPal, transactions can take several days to clear.

While Western Union is a trusted provider, it can be expensive as it charges fees for each transaction. Swift Financial, on the other hand, charges a flat fee per message, making it a more cost-effective option.

Advantages of Using Swift Financial

There are many advantages to using Swift Financial, including:

Speed

Swift Financial transactions are processed quickly, with most transfers completed within minutes. This makes it ideal for time-sensitive payments, such as paying suppliers or receiving wages.

Security

Swift Financial uses a secure messaging system, which ensures that transactions are safe from fraud or interception. The system also requires authentication from all parties involved in a transaction, providing an added layer of security.

Reliability

As a global network, Swift Financial is available 24/7, ensuring that transactions can be completed at any time. This makes it a reliable option for businesses and individuals who need to make or receive payments at any time of day.

Advice for Using Swift Financial

To make the most out of Swift Financial, here are some tips:

Familiarize yourself with the system

Before using Swift Financial, take some time to familiarize yourself with its features and how it works. This will help you to understand the process and ensure that your transactions are completed smoothly.

Choose the right financial institution

When using Swift Financial, it’s important to choose a reputable financial institution that has experience with the system. This will ensure that your transfers are completed quickly and securely.

Check the fees

Swift Financial charges a flat fee per message, which can vary depending on the financial institution. Before making a transfer, check the fees to ensure that you’re getting the best deal.

Frequently Asked Questions

Q: Is Swift Financial only for businesses?

A: No, Swift Financial is available to both businesses and individuals.

Q: Can I use Swift Financial to send money overseas?

A: Yes, Swift Financial can be used to send money anywhere in the world.

Q: How long does it take for a Swift Financial transaction to clear?

A: Most Swift Financial transactions are completed within minutes.

Q: Is Swift Financial secure?

A: Yes, Swift Financial uses a secure messaging system and requires authentication from all parties involved in a transaction.

Q: Can I track my Swift Financial transactions?

A: Yes, you can track your Swift Financial transactions using the system’s tracking feature.

Conclusion

Swift Financial is a fast and secure way of sending and receiving money. With its global reach and standardized messaging system, it’s an ideal option for businesses and individuals who need to make time-sensitive payments. By familiarizing yourself with the system, choosing the right financial institution, and checking the fees, you can make the most out of Swift Financial and take advantage of its many benefits.